(source: seekingalpha.com)

The Russian ruble has dropped about 2.5% a month since August, despite being heavily supported by the Bank of Russia. The cause is, of course, the fall in oil prices. About three quarters of Russia’s exports are related to oil, and the revenue generated by oil sales funds much of the government’s budget. They need oil at about $70 a barrel to pay their bills.

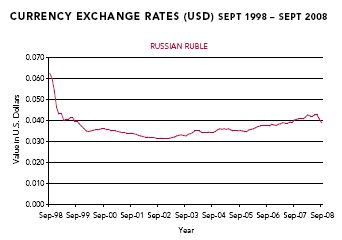

The chart below shows a long-run perspective on the ruble:

The chart does not show all of the recent drop in price. A recent price of the Rydex Russian Ruble Trust (XRU) is $35.57 which translates to about a $.0357 price for a ruble.

Some investors fear that a devaluation of the ruble of 25% to 30% is needed to find a stable bottom, and we may see this kind of devaluation if the price of oil doesn’t turn up soon. The Bank of Russia has been supporting the ruble with its own dollar and euro reserves of about $450 billion, but these assets have dropped 25% since they began defending it in August. At this rate, they cannot keep up their defense for another year.

To help staunch the fall of their currency the Bank of Russia has raised interest rates on ruble deposits to 13%, but this has not worked, at least not yet. International hot money flows are in a state of shock for now. Investors are risk averse to a point not seen in decades, so it doesn’t look as if the carry trade will bail them out of their current crisis.

Domestic growth could help some in coping with falling oil prices. Its economy has been in a growth spurt for several years, but many economists expect its internal growth to fall next year---perhaps as low as 3%. This will not be enough to offset the steep decline in oil prices, given their outsized dependence on petroleum products. An expected pipeline from its eastern neighbors through Russia will probably add some revenues in the future, but that will not be enough or in time to help the current situation.

If Russia wants to sustain its growth with domestic spending it needs to adjust its tax base to be less dependent on oil and reform its poor legal infrastructure for financial institutions. A modern banking system is a must for them to move to higher level of development, but much of their present banking structure is a privatized, cosmetic makeover of the old communist system of state owned savings banks. This will not do if they want to shift to a more sustainable model of domestic growth.

For currency investors, the Rydex Russian Ruble Trust has an inception date of 11/10/08, so it doesn't have much of a track record. If I were a gambler, shorting this ETF would be a play that could have a good payoff--if there are enough long positions to support short sales.

Also, the drop in the ruble has ugly consequences for Russian equity shares. The chart below show the Van Eck Russian ETF (RSX) over the last six months.

The fall in the Russian equities market exceeds the magnitude of the fall in the ruble, but the ruble has certainly contributed to the weakness of the stock market.

As with any emerging market, Russia has great promise and great risks. For investors, a long term perspective and high tolerance for risk is required for a play in either the currency or equities market.

Disclosure: Author has no position in either the Russian equities market or their currency.

-----------------

No comments:

Post a Comment