Zimbabwe knocks 12 zeroes off inflation-hit dollar

Mon Feb 2, 2009 7:33am EST

By Nelson Banya

HARARE (Reuters) - Zimbabwe's central bank revalued its dollar again on Monday, lopping another 12 zeros off its battered currency to try to tame hyperinflation and avert total economic collapse.

The crisis has been worsened by political stalemate between President Robert Mugabe and his rival Morgan Tsvangirai, but the opposition last week agreed to join a coalition government, raising prospects the economy could be saved from further ruin.

The southern African country is battling the world's highest inflation rate, officially put at 231 million percent, and acute shortages of food and foreign exchange.

Reserve Bank of Zimbabwe Governor Gideon Gono announced the new currency moves on Monday, adding that some foreign exchange controls will be relaxed and gold producers now can sell bullion directly and not to the central bank as in the past.

"This Monetary Policy Statement unveils yet another necessary program of revaluing our local currency, through the removal of 12 zeroes, with immediate effect," Gono said in his MPC statement.

Late last month the country allowed businesses to charge in foreign currencies in a bid to tackle inflation and Gono said those businesses could pay their workers in foreign currency.

The country's stock exchange, which has not traded for two months, would also be licensed to trade in foreign currency once listed firms and the exchange provide evaluation criteria.

Gono gave no updated inflation figures but said broad money supply growth rose from 81,000 percent in January to 658 billion percent in December.

"His statement does contain some positive measures but it does not go far enough. It would appear he is trying to restore the Zimbabwean dollar, but given the choice of multiple currencies, who would want to trade in Zimbabwe dollars?" John Robertson, a leading Harare-based economist said.

Tsvangirai, who had been under heavy pressure from southern African leaders to implement a September 15 power-sharing pact with Mugabe, is now set to become prime minister.

The unity government may be a step toward saving a once prosperous country where over half of the people now need food aid and a cholera epidemic has killed 3,229 people and infected 62,909 others -- Africa's deadliest outbreak in 15 years.

Gono said production in every major economic sector had taken a plunge.

Output of gold, the country's single major foreign currency earner, plunged by 50 percent in 2008 as companies grappled with rising costs and electricity shortages.

© Thomson Reuters 2008. All rights reserved. Users may download and print extracts of content from this website for their own personal and non-commercial use only. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world.

Thomson Reuters journalists are subject to an Editorial Handbook which requires fair presentation and disclosure of relevant interests.

Tuesday, February 3, 2009

Zimbabwe knocks 12 zeroes off inflation-hit dollar

Thursday, January 29, 2009

Zimbabwe abandons its currency

Zimbabwe abandons its currency

Zimbabweans will be allowed to conduct business in other currencies, alongside the Zimbabwe dollar, in an effort to stem the country's runaway inflation.

The announcement was made by acting Finance Minister Patrick Chinamasa.

BBC southern Africa correspondent Peter Biles says the Zimbabwean dollar has become a laughing stock. A Z$100 trillion note was recently introduced.

Until now only licensed businesses could accept foreign currencies, although it was common practice.

The country is also facing a deepening humanitarian crisis as well.

A cholera outbreak has killed over 3,000 people according to the World Health Organization (WHO).

And the World Food Programme (WFP) has revised up the number of people it says need food aid.

It now says seven million Zimbabweans are in need of food aid, up from 5.1 million in June.

WFP regional spokesman Richard Lee said the situation had deteriorated rapidly.

"The economic situation has worsened more dramatically than we had anticipated," he told AFP.

"The agency is being forced to halve the cereal rations given to hungry Zimbabweans so that all the people in need can receive aid."

Hyperinflation

Mr Chinamasa made the announcement as he delivered the annual budget to parliament.

"In line with the prevailing practices by the general public, [the] government is therefore allowing the use of multiple foreign currencies for business transactions alongside the Zimbabwean dollar," he said.

The country is in the grip of world-record hyperinflation which has left the Zimbabwean dollar virtually worthless - 231m% in July 2008, the most recent figure released.

Teachers, doctors and civil servants have gone on strike complaining that their salaries - which equal trillions of Zimbabwean dollars - are not even enough to catch the bus to work each day.

Worthless

A 40-year-old Zimbabwean primary school teacher from the capital Harare, told the BBC news website earlier this week it cost nearly US$2 a day to travel to work, but inflation had reduced the average teacher's wage to the equivalent of US$1 a month.

He said he now made a living reselling maize to families in high density areas, as it made more money than teaching.

Before the announcement, shops in Zimbabwe were increasingly demanding payment in US dollars - a reality acknowledged by Mr Chinamasa.

"In the hyper-inflationary environment characterising the economy, our people are now using multiple currencies alongside the Zimbabwean dollar. These include the [South African] rand, US dollar, Botswana pula, euro and British pound among others."

A Harare resident said even street vendors were refusing to accept Zimbabwean notes.

Last year, the Central Bank was forced to slash 10 zeros from the local unit in an effort to make the currency more manageable.

Correspondents say that although the local currency will still be printed, all prices will be set in US dollars, making the Zimbabwe dollar irrelevant.

The country's economy is now on the brink of collapse - a situation worsened by the political crisis that resulted from last year's disputed presidential elections.

Story from BBC NEWS:

http://news.bbc.co.uk/go/pr/fr/-/2/hi/africa/7859033.stm

Published: 2009/01/29 19:01:38 GMT

© BBC MMIX

Monday, January 19, 2009

Sunday, January 18, 2009

Saturday, January 17, 2009

Zimbabwe to launch Z100 trillion dollar note

Zimbabwe to launch Z100 trillion dollar note

Nelson Banya

Reuters North American News Service

Jan 16, 2009 13:51 EST

HARARE, Jan 16 (Reuters) - Zimbabwe's central bank will issue a 100 trillion Zimbabwe dollar banknote, worth about $33 on the black market, to try to ease desperate cash shortages, state-run media said on Friday.

Prices are doubling every day and food and fuel are in short supply. A cholera epidemic has killed more than 2,000 people and a deadlock between President Robert Mugabe and the opposition over power sharing has dampened hopes of ending the crisis.

Hyper-inflation has forced the central bank to keep issuing new banknotes which quickly become almost worthless. There is an official exchange rate, but most Zimbabweans resort to the informal market for currency transactions.

As well as the Z$100 trillion dollar note, the Reserve Bank of Zimbabwe plans to launch Z$10 trillion, Z$20 trillion and Z$50 trillion notes, the Herald newspaper reported.

"... the Reserve Bank of Zimbabwe has introduced a new family of banknotes which will gradually come into circulation, starting with the Z$10 trillion," the Herald said, citing a central bank statement.

Previous banknote issues have done little to ease the plight of Zimbabweans who often line up for hours outside banks to withdraw barely enough to buy a loaf of bread.

Critics blame the economic meltdown on government mismanagement, including the seizure and redistribution of thousands of white-owned farms. The once-thriving farm sector has fallen into ruin.

Mugabe, 84, in power since independence from Britain in 1980, says Western sanctions are the main cause of the economic crisis and worsening humanitarian situation.

A worsening cholera epidemic has piled pressure on politicians to bury their differences and try to ease the suffering of millions. The disease has killed 2,225 people out of 42,675 cases, U.N. figures show.

Political analysts say the establishment of a unity government between Mugabe's ZANU-PF party and the opposition Movement for Democratic Change (MDC) is the best hope of reversing the economic slide and the humanitarian crisis.

But power-sharing talks are deadlocked over the control of key ministries. Tsvangirai accuses Mugabe of trying to assign the MDC a junior role and has demanded the release of detained opposition members and activists.

Detainees include rights campaigner Jestina Mukoko, accused with others of plotting to topple Mugabe. A court gave her permission on Friday to ask the Constitutional Court to release her.

In neighbouring South Africa, European and South African ministers called on the Zimbabwean parties to implement their agreement.

"Ministers expressed grave concern at the ongoing violence and abductions and recognised that a political solution to Zimbabwe's problems is critical to bringing an end to this cycle," they said in a statement.

The presidents of South Africa and Mozambique meet Zimbabwean political parties on Monday in a new push to break the impasse.

Source: Reuters North American News Service

--------------------------

Buy Gold & Silver

Friday, January 2, 2009

U.S. to get New Currency by June, 2012

A gift from Jim

Jim's comments on Alf Field's Gold Price Predictions

--------------------------

Buy Gold & Silver

Tuesday, December 23, 2008

Thursday, December 18, 2008

Will printing money help the economy?

Will printing money help the economy?

What's the wisdom behind the Fed's recent actions? Doug Henwood and Brian Doherty debate.

December 17, 2008 - LATimes.com

Today's question: Critics say that the Federal Reserve -- which will buy up to $800-billion worth of troubled mortgage and consumer-credit assets -- is effectively printing money to fix the economy. What's the wisdom behind the Fed's actions? Doug Henwood and Brian Doherty debate the consequences of federal monetary policy.

It's better to inflate than deflate.

Point: Doug Henwood

It's not just critics who say the Fed is printing money to fix the economy. That's what it's doing, and I don't see what's wrong with it.

Back in 2002, Federal Reserve Chairman Ben S. Bernanke gave a speech reflecting on what a central bank might do if faced with the threat of deflation -- an extended period of falling prices. Falling prices might sound nice, but over the last century, they've generally accompanied severe economic crises, like Japan in the 1990s or, worse, the U.S in the 1930s. A deflation turning into a depression is a central banker's worst nightmare. And we're at risk for one of those today.

In that speech, Bernanke -- who made his academic reputation by studying the role of bank failures and other financial troubles in propagating the Depression -- said that everything should be done to prevent a deflation from taking hold, and if one took hold, everything should be done to reverse it. Speaking six years ago, Bernanke laid out the framework for what the Fed is doing today -- deep cuts in interest rates, unorthodox purchases of securities (not the short-term U.S. Treasury paper the Fed usually trades in but long-term bonds, mortgage bonds and even private securities) and financing a big fiscal stimulus by printing money. "If we do fall into deflation ... we can take comfort that the logic of the printing press ... must assert itself, and sufficient injections of money will ultimately always reverse a deflation," he said.

For further perspective on current events, we can turn to a classic 1933 paper on debt deflations by economist Irving Fisher. His model boils down to this: Some shock hits the economy, resulting in an increase in pessimism and asset sales. Asset sales drive down prices, leading to more pessimism and distress selling. That results in a shrinkage in the money supply and a decline in velocity (the speed at which money turns over, a function of how quickly people spend). Prices for goods and services fall, hitting profits and raising the real value of debts. Businesses go bust. Managers of surviving firms cut production and employment.

This deepens pessimism, leading those with cash to hoard it. Repeat in a vicious cycle. The point of Bernanke's printing press is to arrest and reverse this process.

Fisher, writing when the New Deal was only months old, noted that FDR's early policies of imposing a bank holiday (after 10,000 had failed) and going off the gold standard quickly reversed the deflation and marked the beginning of an economic recovery. After contracting by 27% between 1929 and 1933, the economy grew 43% from 1933 to 1937.

Sure, printing money sounds awful, but not as bad as watching the unemployment rate hit 25%, as it did in 1933.

Libertarians consider this an interference with the self-adjusting beauties of the free market. Some even argue that the New Deal made the Depression worse, by not allowing the system's excesses to be purged, through some economic equivalent of a high colonic. Bernanke doesn't agree, and I'm glad for that.

Doug Henwood edits the Left Business Observer and does a weekly radio show on WBAI-FM in New York and KPFA-FM in Berkeley.

Runaway inflation would cause far more misery than a bit of deflation.

Counterpoint: Brian Doherty

Deflations can be grim, and inflations can be grim. As a way to help ameliorate -- though not eliminate -- these often damaging fluctuations in currency value, I'm going to speak up for a line of thought I've long been sympathetic to: the hard money school of economics (the Austrian variety is my favorite) which posits that the best way to "manage" the money supply is to remove from political authorities the ability to make more of it willy-nilly.

The most dire eventuality of government's ability to inflate its way out of perceived problems (as I fear Bernanke is gearing up to do today) dwarfs even the difficulties in America in the 1930s or 1990s Japan (more on that in a minute). See the hyperinflations of Germany in the 1920s, Hungary in the 1940s and, more recently, Zimbabwe.

Given Bernanke's firmly stated beliefs, and the fear of the early '30s deflation you mention, we have far more reason to fear inflation out of control than rampant deflation. Inflation out of control means, among other evils, the wiping out of most savings and most Americans seeing their real resources gradually shrink even with apparent monetary gain.

Deflation, especially of the mild variety we might be seeing right now, need not lead to the looping downward spiral of Fisher's model. In the last half of the 19th century, for example, America saw overall price deflation combined with overall healthy economic growth (with some ups and downs along the way). See this data sheet from the St. Louis Federal Reserve Bank on how deflationary episodes can correspond with economic growth and health.

Even if Fed money supply looseness doesn't lead to a repeat of a 1923 Germany horror show, I think we have recent evidence indicating that a Bernanke inflation solution might not save us. Although Doug has elsewhere argued that the problem was Japanese authorities not acting quickly enough, I think the experience of Japan in the 1990s -- where at least 10 attempts at massive fiscal stimulus, lowering interest rates to rock bottom and raising the money supply all failed to propel the nation from recessionary doldrums -- should at least make us wonder if Bernanke's policy is worth the risk.

Yes, deflationary hangover adjustments from years of cheap credit and money growth can be painful, which is why free-market, hard-money types advocate eschewing willy-nilly credit and money growth in the first place. One big worry arising from Bernanke's current intentions is that if we seem hellbent on increasing the quantity of these mysterious paper things to get out of today's mess, those things are going to be worth less -- far less -- even if that inflationary action solves an apparent short-term problem.

And that could hasten the day when the people who lend the U.S. money in the hopes of getting back something that's worth close to what they lent us will stop. Which, as gold goes up and the dollar down, leads us to tomorrow's topic, roughly: How much government debt is too much?

Brian Doherty is a senior editor at Reason magazine and author of "Radicals for Capitalism" and "Gun Control on Trial."

---------------------------

Buy Gold & Silver

Saturday, December 13, 2008

The Four Stages of Inflation

http://mises.org/Books/mysteryofbanking.pdf

--------------------------

Buy Gold & Silver

Friday, December 12, 2008

The roots of hyperinflation

Re-posted from jsmineset.com:

The roots of hyperinflation

I have written the following because I do not think the dangers of hyperinflation and currency collapse are understood;

Peter Shann

The most widely accepted view is that hyperinflation and monetary collapse results from governments introducing large amounts of fiat money into the economy, Wikipedia comments;

"The main cause of hyperinflation is a massive and rapid increase in the amount of money, which is not supported by growth in the output of goods and services. This results in an imbalance between the supply and demand for the money (including currency and bank deposits), accompanied by a complete loss of confidence in the money, similar to a bank run"

This explanation is superficial and doesn’t provide answers as to why governments would in the first instance "massively and rapidly increase the amount of money" nor why they would.

I feel compelled to continue with this as inflation increases by factors of thousands of percent and in some extreme instances print banknote in denominations of 100,000,000,000,000 currency units, it also fails to explain why newly issued money is not primarily invested in asset class goods or why goods that can easily be replicated, as can most essential consumables, be often subject to the greatest price inflation.

A prerequisite of hyperinflation and monetary collapse is that a disruption in the availability of essential goods occurs, today this could happen as a result of past reliance on expanding credit and fiat money temporally facilitating dependency on low cost imported goods many of which now feed primary needs leading to a commensurate loss of home production capacity with an inherent delay to the medium-term should such reengagement with manufacture become necessary as it would in the event of off shore suppliers losing confidence in reciprocal worth of monetary instruments offered in exchange for goods, and or shortage of essential goods may arise as a result of natural correction occurring, by way of example from the collapse of speculation driven credit markets and or as a result of collateral damage to the production cycle caused by inappropriate governmental action in further increasing money and credit supplies in attempt to drive a spontaneously occurring and necessary correction back in the direction of instability and in so doing distorting essential work ethics and disincentivising investment in the production cycle,

In my view the most probable sequence of events resulting in hyperinflation and monetary collapse is as follows:

1. A broad based shortage of goods that are thought essential develops and this is not relieved in time to satisfy demand.

2. Consumers trying to acquire essential goods that they believe are in short supply become fearful and are prepared to pay increasingly higher prices and stockpile these goods further increasing shortages and accelerating prices as a sellers market develops.

3. Prices rise for essential goods in short supply as an increasing proportion of the money supply circulates in these goods, also with increasing velocity and as most of these goods are consumables with high turnover upward re pricing quickly occurs.

4. The proportion of available money circulating in goods that are perceived as essential increases and the demand for less essential goods diminishes I.e essentials become disproportionately more expensive than the norm against non essential goods displacing money towards the goods most in demand further fuelling inflation,

5. The shortage of essential goods accelerates as manufactures increasingly focus on short term survival, longer term risk is avoided and investment in the production cycle is reduced accelerating 1.

6. The normal balance of demand for all goods increasingly prefers those goods required to satisfy primary needs and people engaged in making and supplying less immediately essential or non essential goods become unemployed who then pressures governments accelerating condition 9.

7. Eventually goods not immediately required but non the less essential are needed and rapidly increase in price as they also become in short supply.

8. Consumers with least money first find it increasingly difficult to secure essential goods, become frightened and are forced to allocate greater proportions of their money on essential goods and demand greater income,

9. The demand for money forced by need and fear becomes irresistible so governments feel insecure and provide increasing amounts of fiat new money,

10. Consumers first to spend the new money see some value but soon as this new money is distributed and its value is lost, the velocity of money also accelerates as people rapidly exchange money for goods, wealth is seen as best protected when stored as goods rather than cash further increasing price and reinforcing condition 9.

----------------------------------

The "crack-up boom"

The Worldwide Crack Up Boom, According to Ludwig Von Mises

By Bill Bonner • June 26th, 2007

A kiss is still a kiss. A sigh is still a sigh. And a bubble is still a bubble.

When a kiss is over, it's over. When a bubble pops...well...that's all she wrote! All kisses end - even the wettest "French" kisses. And so do all bubbles - even sloppy mega-bubbles of liquidity. This one will be no exception. But of course, it's not the certainties that make life interesting...it's the uncertainties - the known unknowns and the unknown unknowns, as Mr. Rumsfeld says. We are all born of woman and end up where all men born of women end up - dead. But that doesn't mean we can't have some fun between baptism and last rites.

You'll remember we said that this worldwide financial bubble is both worldlier, and more financial than any in history.

And, for the moment, it is very much alive. So much alive that the media can hardly keep up with it. Forbes magazine, for example, tries to estimate the wealth of the world's richest people. But the rich don't typically give out their balance sheets, telephone numbers and home addresses. So, there's a fair amount of guesswork in the calculations.

But when it came to guesstimating the net worth of Stephen Schwarzman, founder of Blackstone, the Forbes crew wandered off into fiction. They put his wealth at about $2 billion. Recent filings in connection with the new Blackstone IPO show he earned that much in a single year!

In this phase of the bubble, it is as if your neighbors were throwing a wild party - and you weren't invited. You detest them... envy them... and want to join them, all at once. A very small part of the population is having a ball; everyone else is getting restless and wondering when the noise will stop.

We wish we knew. And we've given up guessing.

Meanwhile, the experts, commentarists, kibitzers and analysts are saying that there is a whole new phase of the giant bubble about to unfold; things could get a whole lot crazier. Even many of our respected colleagues are pointing to a text by the great Austrian economist, Ludwig von Mises, for a clue. What we have here, they say, is what Mises described as a "Crack-Up Boom."

Before we go on, readers should be aware that the "Austrian school" of economics is probably the best theory about the way the world works. Like The Daily Reckoning, it is suspicious of efforts to control the natural workings of an economy, in general...and suspicious of central banking, in particular. The fact that it was a one-time "Austrian," Alan Greenspan, who became the most celebrated central banker in history, only increases our suspicions. He was able to master central banking, we imagine, because he understood what it really is - a swindle.

What is a "Crack-Up Boom?" Von Mises explains (with thanks to Ty Andros for reminding us):

"'This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.'

"But then, finally, the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against 'real' goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

"It was this that happened with the Continental currency in America in 1781, with the French mandats territoriaux in 1796, and with the German mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last."

Mises is describing the lunatic phases of a classic inflationary cycle.

At first, no one can tell the difference between a real dollar - one that is earned, saved, invested or spent - and one that just came off the printing presses. They figure that the new dollar is as good as the old one. And then, prices rise...and people don't know what to make of it. Later, they begin to catch on...and all Hell breaks loose.

You see, if you could really get rich by printing more currency, Zimbabweans would all be as rich as Midas, since the Mugabe government runs the presses night and day.

Von Mises died in 1973 - long before this boom really got going - let alone cracked up. He may never have heard of a hedge fund...or even a derivative, for that matter. A world money system without gold? He probably couldn't have imagined it. People spending millions of dollars for a Warhol? Twenty million for a house in Mayfair? Chinese stocks at 40 times earnings? He would have chuckled in disbelief. He understood how national currency bubbles expand and how they pop, but he probably never would have imagined how insane things could get when you have a whole world monetary system in bubble mode.

He'd have recognised the beginning of this bubble...and he'd have recognised the end, but the middle...or the beginning of the end - that would have dumbfounded him. During his lifetime he saw a Crack Up Boom in Germany in the '20s...and a few more here...but he never saw a worldwide Crack Up Boom.

No one, anywhere, has ever seen a worldwide Crack Up Boom. We're the first, ever. Pretty exciting, huh?

Bill Bonner

The Daily Reckoning Australia

---------------------------

Buy Gold & Silver

Russians Buy Jewelry, Hoard Dollars as Ruble Plunges - USA next?

Russians Buy Jewelry, Hoard Dollars as Ruble Plunges (Update1)

By Emma O’Brien and William Mauldin

Dec. 11 (Bloomberg) -- Moscow resident Tima Kulikov banked on the full faith and credit of the U.S. government, not the Kremlin, when he sold his biggest asset for cash.

The 31-year-old director of a social networking Web site initially agreed to sell his apartment for rubles, then cringed at the thought of the currency weakening as it sat in a lockbox pending settlement of the contract. It wasn’t until the buyer showed up with $250,000 stacked in old mobile-phone boxes and stuffed in his pockets that Kulikov closed the deal.

“The exchange rate we agreed on wasn’t great, but I did it because the money’s going to lie there for a month,” Kulikov said. “Put it this way, the ruble’s more likely to have problems than the dollar.”

Russians are shifting their cash into foreign currencies and buying things they don’t need as the economy stalls and the central bank weakens its defense of the ruble, signaling a larger devaluation may be on the way. The currency has fallen 16 percent against the dollar since August, when Russia’s invasion of neighboring Georgia helped spur investors to pull almost $200 billion out of the country, according to BNP Paribas SA.

The central bank today expanded the ruble’s trading band against a basket of dollars and euros, allowing it to drop 0.8 percent, said a spokesman who declined to be identified on bank policy.

With the specter of the 1998 debt default and devaluation in mind, Russians withdrew 355 billion rubles ($13 billion), or 6 percent of all savings, from their accounts in October, the most since the central bank started posting the data two years ago. Foreign-currency deposits rose 11 percent.

Oligarchs Pinched

Those withdrawals are increasing pressure for the ruble’s devaluation, according to Basil Issa, an emerging- markets analyst at BNP Paribas in London.

Property is now a protective investment, not just a status symbol, said Sergei Polonsky, founder of real estate developer Mirax Group, which is building Moscow’s tallest skyscraper.

“Lately our clients are mostly those who buy real estate not to live in but to secure their investments,” Polonsky said. “No one wants to be left with pieces of paper.”

The 25 wealthiest Russians on Forbes magazine’s list of billionaires, including Oleg Deripaska and Roman Abramovich, lost a combined $230 billion from May to October as asset values plummeted, according to Bloomberg calculations.

‘Feel Happy’

For the burgeoning middle class, investments of choice range from electronics to gold jewelry. Evroset, Russia’s largest mobile-phone chain, is telling people to buy anything they can.

“It’s better to feel happy that you own something than to fear losing the money you have earned,” Chairman Yevgeny Chichvarkin says in a letter posted at 5,200 Evroset stores. “If you need a car, buy a car! If you need an apartment, buy an apartment! If you need a fur coat, buy a fur coat!”

Sales at Technosila, the third-biggest consumer electronics chain, have doubled since September as customers rush to swap rubles for flat-screen TVs and laptops, spokeswoman Nadezhda Senyuk said by phone from Moscow, where the company is based.

Jewelry sales are also accelerating, particularly items made of gold and diamonds, said Vladimir Stankevich, advertising director at Adamas, Russia’s third-largest jewelry retailer.

“More cash appeared on the market and there’s an opinion among shoppers that gold is a good investment in times of crisis,” Stankevich said.

Natalya Kulikova has a different approach. The 31-year-old sales manager said she’s opened accounts in rubles, euros and dollars at three different banks -- one foreign and two domestic -- to guard her savings.

“My main goal is to save money,” she said.

Putin Pledge

Those who don’t want to spend are keeping more money at home or in safe-deposit boxes because the government guarantee on bank accounts is limited to 700,000 rubles, said Yulia Tsepliaeva, chief economist in Moscow at Merrill Lynch & Co.

Alfa Bank, Russia’s biggest non-state lender, said demand for boxes has increased about 40 percent since October, and there are few available.

“The Russian experience with saving is not that good and people prefer to consume and enjoy rather than save in pre-crisis situations,” Tsepliaeva said. “Buy cash dollars and put them in mattresses or safe deposit boxes but not in accounts because most crises are accompanied by banking crises.”

A decade ago, many lost their life savings after the ruble plunged 71 percent against the dollar. Those fears prompted Prime Minister Vladimir Putin to pledge not to allow “sharp jumps” in the exchange rate, during a call-in television show Dec. 4.

‘Ideal Time’

Troika Dialog, Russia’s oldest investment bank, is betting the central bank will allow a one-time devaluation of the ruble of about 20 percent in January, following New Year’s and Orthodox Christmas celebrations.

“With the holidays at the beginning of January, companies won’t be fully working and people will be spending more money,” said Evgeny Gavrilenkov, Troika’s chief economist and a former acting head of the government’s Bureau of Economic Analysis. “That means demand for rubles will increase and that means it’s an ideal time to allow a devaluation.”

Russia has drained almost a quarter of its foreign-currency reserves, the world’s third-largest, since August as it tries to slow the ruble’s decline. The central bank has widened the trading band five times in the past month, effectively reducing its defense of the currency amid plunging oil prices.

Devaluation Skeptic

Urals crude, Russia’s main export earner, has slumped 72 percent since reaching a record $142.94 a barrel July 4. It fell below $40 for the first time in three years last week, compared with the $70 needed to balance the country’s budget.

The government will avoid a large, one-step devaluation because it wants to prevent a run on the banks and lure back foreign investors, said Chris Weafer, chief strategist in Moscow at UralSib Financial Corp.

“I’m skeptical a 10 to 15 percent devaluation will provide a significant boost for the economy because the sector that it will most benefit, manufacturing, is just too small,” he said.

The ruble will probably be allowed to drop in small steps to as low as 33 per dollar by the middle of 2009, from about 28 now, Weafer estimates. It will end next year at 26.8 because of a recovery in oil prices and a weaker U.S. currency, he said.

Svetlana Guseva isn’t taking any chances.

The 32-year-old mother of two from the southern city of Sochi plans to take her 8-year-old daughter, Dasha, to Moscow for the New Year’s holiday, a trip that will cost twice her family’s monthly income of about 30,000 rubles.

“This way at least we’ll have some memories,” she said.

To contact the reporters on this story: Emma O’Brien in Moscow at eobrien6@bloomberg.net; William Mauldin in Moscow at wmauldin1@bloomberg.net.

Last Updated: December 11, 2008 03:51 EST

-----------------------------

Buy Gold & Silver

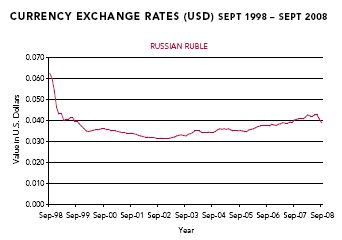

A Fast Fall for the Russian Ruble

(source: seekingalpha.com)

The Russian ruble has dropped about 2.5% a month since August, despite being heavily supported by the Bank of Russia. The cause is, of course, the fall in oil prices. About three quarters of Russia’s exports are related to oil, and the revenue generated by oil sales funds much of the government’s budget. They need oil at about $70 a barrel to pay their bills.

The chart below shows a long-run perspective on the ruble:

The chart does not show all of the recent drop in price. A recent price of the Rydex Russian Ruble Trust (XRU) is $35.57 which translates to about a $.0357 price for a ruble.

Some investors fear that a devaluation of the ruble of 25% to 30% is needed to find a stable bottom, and we may see this kind of devaluation if the price of oil doesn’t turn up soon. The Bank of Russia has been supporting the ruble with its own dollar and euro reserves of about $450 billion, but these assets have dropped 25% since they began defending it in August. At this rate, they cannot keep up their defense for another year.

To help staunch the fall of their currency the Bank of Russia has raised interest rates on ruble deposits to 13%, but this has not worked, at least not yet. International hot money flows are in a state of shock for now. Investors are risk averse to a point not seen in decades, so it doesn’t look as if the carry trade will bail them out of their current crisis.

Domestic growth could help some in coping with falling oil prices. Its economy has been in a growth spurt for several years, but many economists expect its internal growth to fall next year---perhaps as low as 3%. This will not be enough to offset the steep decline in oil prices, given their outsized dependence on petroleum products. An expected pipeline from its eastern neighbors through Russia will probably add some revenues in the future, but that will not be enough or in time to help the current situation.

If Russia wants to sustain its growth with domestic spending it needs to adjust its tax base to be less dependent on oil and reform its poor legal infrastructure for financial institutions. A modern banking system is a must for them to move to higher level of development, but much of their present banking structure is a privatized, cosmetic makeover of the old communist system of state owned savings banks. This will not do if they want to shift to a more sustainable model of domestic growth.

For currency investors, the Rydex Russian Ruble Trust has an inception date of 11/10/08, so it doesn't have much of a track record. If I were a gambler, shorting this ETF would be a play that could have a good payoff--if there are enough long positions to support short sales.

Also, the drop in the ruble has ugly consequences for Russian equity shares. The chart below show the Van Eck Russian ETF (RSX) over the last six months.

The fall in the Russian equities market exceeds the magnitude of the fall in the ruble, but the ruble has certainly contributed to the weakness of the stock market.

As with any emerging market, Russia has great promise and great risks. For investors, a long term perspective and high tolerance for risk is required for a play in either the currency or equities market.

Disclosure: Author has no position in either the Russian equities market or their currency.

-----------------

Friday, December 5, 2008

Peter Schiff: Low Rates, Big Problems

Low Rates, Big Problems

By: Peter Schiff, Euro Pacific Capital, Inc.

-- Posted Friday, 5 December 2008 | Source: GoldSeek.com

Government and mainstream economists have erroneously concluded that the key to reversing the financial free fall can be found in stopping the plunge in home prices. (I would offer the corollary that the key to reducing injuries in auto accidents is to suspend the laws of inertia). But to accomplish the improbable task of re-inflating the housing bubble, the government appears ready to announce a coordinated plan to push down mortgage rates to just 4.5%. Of course, this is precisely the wrong solution to the housing crisis, but when it comes to bad ideas our government has been remarkably consistent.

The plan would require the newly created Federal agencies of Fannie Mae and Freddie Mac to lower rates to 4.5%, and then require the Fed to directly buy the loans after they were made. The idea is that by lowering mortgage rates, current homeowners will be able to afford to make their payments, and new buyers will be more likely to qualify for larger loans, provided of course they do not have to come up with a burdensome down payment. If 4.5% is not enough to convince reluctant borrowers then look for the mandated rate to drop further. Perhaps there may come a time where the interest flows to the borrower instead of the lender. Anything to get Americans borrowing again.

But artificially suppressing mortgage rates will encourage risk taking and debt assumption at a time when consumers and lenders should be acting prudently. By setting rates below market levels, and buying mortgages that no private funder would want to touch, the government is creating a mortgage entitlement. Given the size of the home mortgage market, the program could eventually become one of the largest entitlement program on the federal books.

The most obvious problem is that the Government has no money. All it has is a printing press. So the more money it provides for cheap mortgages, the higher the inflation tax will be for all Americans. Higher inflation will cause the difference between where rates should be and where the government sets them to grow wider, and the entitlement to become more costly to provide.

Assuming $5 billion in mortgages are refinanced at 4.5% in an environment where the unsubsidized rate would have been 10%. The annual cost to the government in such a scenario would be $275 billion. But the subsidy will have to be provided in perpetuity, as the minute it is removed, mortgage rates would surge and housing prices would plummet. Of course, the mere existence of the subsidy will continue to create demand for mortgage credit, which the government will be forced to provide by printing even more money. This would set into place a self perpetuating spiral of rising inflation and mortgage demand, with practically 100% of mortgage money being provided by the government. Ultimately the whole scheme would collapse, as run-away inflation would completely destroy what would be left of our shattered economy.

Some argue that since the government can now borrow for 30 years at 3%, issuing mortgages at 4.5% is a winning trade. There are three problems with this analysis. First, just because money is cheap does not mean we should borrow it-you think we would have at least learned that by now! Second, this analysis does not factor in default related losses. Finally, there is no way the government would be able to borrow that much money at the long end of the rate curve without driving interest rates much higher. The only reason long-term rates are so low now is that the government is concentrating its borrowing on the short end of the curve. So to pull of the trade, the government will have to finance it with treasury bills. If we turn the government into a massively leveraged hedge fund that cycles a multi-trillion dollar carry trade of short-term debt used to finance long term mortgages, then I think we already know how that movie ends.

In the final analysis the market must be allowed to function. If real estate prices are too high they must be allowed to fall, regardless of the consequences. Lower prices are the market's solution to housing affordability. Government attempts to artificially prop up prices will have much more dire economic consequences then letting them fall. Until we figure this out, there will be no escape from the economic death spiral the government is setting in motion.

For a more in depth analysis of our financial problems and the inherent dangers they pose for the U.S. economy and U.S. dollar, read my just released book "The Little Book of Bull Moves in Bear Markets." Click here to order your copy now.

For a look back at how I predicted the current crisis, read my 2007 bestseller "Crash Proof: How to Profit from the Coming Economic Collapse." Click here to order a copy today.

More importantly, don't wait for reality to set in. Protect your wealth and preserve your purchasing power before it's too late. Discover the best way to buy gold at www.goldyoucanfold.com. Download my free Special Report, "The Powerful Case for Investing in Foreign Securities" at www.researchreportone.com. Subscribe to my free, on-line investment newsletter, "The Global Investor" at http://www.europac.net/newsletter/newsletter.asp.

-- Posted Friday, 5 December 2008 | Digg This Article | Source: GoldSeek.com

- Peter Schiff C.E.O. and Chief Global Strategist

Euro Pacific Capital, Inc.

10 Corbin Drive, Suite B

Darien, Ct. 06840

800-727-7922

www.europac.net

schiff@europac.net

Mr. Schiff is one of the few non-biased investment advisors (not committed solely to the short side of the market) to have correctly called the current bear market before it began and to have positioned his clients accordingly. As a result of his accurate forecasts on the U.S. stock market, commodities, gold and the dollar, he is becoming increasingly more renowned. He has been quoted in many of the nation's leading newspapers, including The Wall Street Journal, Barron's, Investor's Business Daily, The Financial Times, The New York Times, The Los Angeles Times, The Washington Post, The Chicago Tribune, The Dallas Morning News, The Miami Herald, The San Francisco Chronicle, The Atlanta Journal-Constitution, The Arizona Republic, The Philadelphia Inquirer, and the Christian Science Monitor, and has appeared on CNBC, CNNfn., and Bloomberg. In addition, his views are frequently quoted locally in the Orange County Register.

Mr. Schiff began his investment career as a financial consultant with Shearson Lehman Brothers, after having earned a degree in finance and accounting from U.C. Berkley in 1987. A financial professional for seventeen years he joined Euro Pacific in 1996 and has served as its President since January 2000. An expert on money, economic theory, and international investing, he is a highly recommended broker by many of the nation's financial newsletters and advisory services.

----------------------------

Buy Gold & Silver

Thursday, December 4, 2008

Dollar set for a fall

UN team warns of hard landing for dollar

By Harvey Morris in New York

Published: December 1 2008 08:48 | Last updated: December 1 2008 08:48

The current strength of the dollar is temporary and the US currency risks a hard landing in 2009, according to a team of United Nations economists who foresaw a year ago that a US downturn would bring the global economy to a near standstill.

In their annual report on the world economy published on Monday, the economists said the dollar’s sharp rebound this autumn had been driven mainly by a flight to the safety of the international reserve currency as the financial crisis spread beyond the US.

The overall trend remained a downward one, however, reflecting perceptions that the US debt position was approaching unsustainable levels. An accelerated fall of the dollar could bring new turmoil to financial markets.

“Investors might renew their flight to safety, though this time away from dollar-denominated assets, thereby forcing the US economy into a hard landing and pulling the global economy into a deeper recession,” the report said.

Publication of the annual survey by the UN’s Department of Economic and Social Affairs, its trade organisation Unctad and UN regional bodies, was brought forward by a month in the light of the financial crisis. It was launched in Doha to coincide with the UN-sponsored development financing conference in the Qatari capital.

The UN team said that, as the financial crisis spread beyond the US, there had been a massive shift of global financial assets into US Treasury bills, driving their yields almost to zero and pushing the dollar sharply higher. At the same time, however, the US’s external debt had risen to new heights that could provoke a dollar collapse.

The report recommends reform of the international reserve system away from almost exclusive reliance on the dollar and towards a globally backed multi-currency system.

Rob Vos, a Dutch economist who heads the UN’s policy and analysis division and who is responsible for the annual economic review, said the global economic pain could be eased if governments co-ordinated a spate of stimulus packages that were already under way.

“There has been a sea change in attitudes in favour of intervention and concerted action,” he told the Financial Times. He welcomed statements from US president-elect Barack Obama’s transition team in support of spending on infrastructure.

Copyright The Financial Times Limited 2008

-------------------------

Buy Gold & Silver

Monday, November 10, 2008

Gimme, gimme, gimme

American Express gets bank-holding company nod

By Lisa Twaronite, MarketWatch

Last update: 6:58 p.m. EST Nov. 10, 2008

SAN FRANCISCO (MarketWatch) -- American Express Co. got approval from the Federal Reserve Board to form a bank-holding company, the central bank said late Monday.

In becoming a holding company, the credit-card giant would get access to the Federal Reserve's emergency-lending facilities, but also will be subject to greater scrutiny by regulators.

The U.S. central bank said that both American Express and its affiliate American Express Travel Related Services are approved to form bank-holding companies, as the Amex group converts its Salt Lake City -based American Express Centurion Bank into a full bank.

The Fed waived the normal 30-day waiting period on the application.

"In light of the unusual and exigent circumstances affecting the financial markets and all other facts and circumstances, the board has determined that emergency conditions exist that justify expeditious action on this proposal in accordance with the provisions of the [Bank Holding Company] Act and the board's regulations," the Fed said.

"The record indicates that consummation of the proposal would create a stronger and more diversified financial-services organization and would provide the current and future customers of Amex, Amex Travel and Amex Thrift with expanded financial products and services," the Fed wrote in its approval. "[B]ased on all the facts of record, the board has concluded that consummation of the proposal can reasonably be expected to produce public benefits that would outweigh any likely adverse effects."

American Express said last month that it would cut 10% of its staff, suspending management salary increases and instituting a hiring freeze, as well as take a pretax restructuring charge of up to $440 million against fourth-quarter results to cover layoff expenses.

Earlier in October, the company said that quarterly net income fell 24% as it set aside more money to cover bad loans. Net income came in at $815 million, or 70 cents a share, compared with $1.07 billion or 90 cents a share a year earlier. Income from continuing operations was $861 million, or 74 cents a share, in the latest quarter, Amex reported.

In September, Wall Street was transformed when investment banks Morgan Stanley and Goldman Sachs Group received Fed approval to convert to bank-holding companies.

Lisa Twaronite reports for MarketWatch from San Francisco.

-------------------

Buy Gold & Silver

Saturday, November 8, 2008

How to pay off your debts for pennies on the dollar

Convert all interest rates on your debts to "fixed" interest rates. Pay the minimums on these debts and pay the maximum on those debts that are "adjustable". Take the rest of your money and buy as much gold and silver as possible. If/when inflation/hyperinflation kicks in you can pay back these debts for pennies on the dollar by selling some of your precious metals. Consider the fact that the dollar can lose most of its value in a currency collapse.

Look at Zimbabwe for a glimpse at the potential future of the dollar:

Zimbabwe Crisis (source)If you think that the current economic crisis is something that has never happened in history before, you may be wrong! After the collapse of the agriculture sector in Zimbabwe in 2000, the inflation in that country skyrocketed to 231 million percent a year! Just think about it - 231 000 000%! Unemployment went up to 80% and a third of country’s population left it.

Let`s now have a look at the photos that you may not be able to see anywhere else in the world.

Here is a boy getting change in 200 000 dollar notes!

One 200 000 dollar note equals less than $0.10 cents.

December 22nd, a new note of 500 000 dollars introduced to the market!

Next - 750 000 dollars.

January - new note of 10 million dollars.

This US $10 dollar note is 10 times worth more than the 10 million dollars Zimbabwe note.

A case worth 65 billion Zimbabwe dollars which equals to $2000 US dollars.

This guy is going to a supermarket. The exchange rate is 25 million Zimbabwe dollars for 1 US dollar.

This mountain of cash is worth $100.

50 Million note is then introduced!

Next is 250 million dollars note!

Sorry, how much is this t-shirt?

- It`s cheap, only about 3 billion dollars!

May - a note of 500 million dollars is introduced!

June - note worth 25 and 50 billion are printed.

And finally - 100 billion dollars note!

What can you buy for it? Well, these 3 eggs for example.

Thats how people went to restaurants!

And the bills:

In August, the government devalued Zimbabwe dollar by removing 10 zeros from notes.

However, inflation kept going up and in September for this amount of cash you could only buy 4 tomatoes.

And for this - some bread.

And then it started again: 20 000 dollars note in September.

50 000 a couple of weeks ago!

They`ve got a pretty good chance of hitting billion dollar notes again by the end of this year!

Layaway making a comeback

Main Street Credit Crisis: Bringing Back Layaway for Purchases. The Anti-Saving Crusade Continues

Saturday, October 25, 2008

How to Protect Against a Hyperinflationary Depression

Here are a couple of ways to protect yourself and your assets:

For Landlords:

Convert your leases to "month to month" rental agreements. This will allow you to raise rents to keep up with the hyperinflation. If it gets really bad, a week to week rental agreement might make sense. If you are locked into a long term lease when a hyperinflation hits, your money coming in could lose up to 50% or more of its' value overnight and even 99% within a matter of months.

For Renters:

Lock yourself into a 2 to 3 year lease if you can. Make sure there is no adjustment for CPI or anything like that. When hyperinflation hits, you can pay a whole month's rent with a single day's pay (assuming you still have a job).

For Homeowners/Debtors:

Make sure your debts are locked in at long-term, fixed-interest rates. Like the renters above, you could, at some point, pay off your mortgage with just a couple week's pay.

For Everyone:

Build up several month's worth of Food Storage because one of the first things you will see is a run on the grocery stores.

Also, immediately withdraw all of your funds from retirement funds, savings, banks, credit unions, CD's, IRA's, etc. Convert these funds to physical gold & silver. Keep about one month's worth of cash on hand and sell a little portion of your gold & silver only as you need it. At some point we might simply go into a barter situation and you could trade your gold/silver and canned goods for other products and services.

If anyone owes you money, consider offering them a discount if they pay you off immediately - especially if you are carrying the note on a long-term, fixed interest rate.

Consider your self-defense and security. Store up on ammunition and get familiar with your firearms (you do own a gun don't you?).

Avoid an ostentatious lifestyle. Ditch the Rolex and the Lexus for something more conservative. There could be a lot of "class angst" and you don't want to be the lightening rod for someone's anger.

Here are a couple of articles worth reading on the likelihood of a Hyperinflationary Depression:

http://www.shadowstats.com/article/292

http://tinyurl.com/6juujd

For an excellent home study course on Economics, and why the economy is the way that it is, we recommend the following:

http://www.freedomschool.org

-----------------------------