Ruble Drops to Pre-1998 Crisis Low on 6th Devaluation This Year

By Emma O’Brien

Jan. 19 (Bloomberg) -- The ruble fell below the weakest level seen in the 1998 Russian crisis after the central bank devalued for the sixth time in seven days to protect reserves.

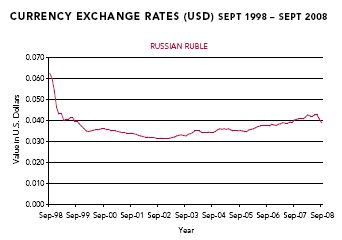

The currency slid to as little as 33.0455 per dollar today, the lowest since early 1998, before the government defaulted on $40 billion of debt. The ruble has lost 7.3 percent since official trading resumed this year, extending the decline to 29 percent since August.

Prime Minister Vladimir Putin pledged last month to use the nation’s foreign-exchange reserves to avoid “sharp” currency swings, after the 71 percent decline against the dollar in 1998 caused investors to flee and savers to pull bank deposits. Investors have withdrawn $245 billion from Russia since August as a 69 percent drop in oil, Russia’s war with Georgia and the disruption to gas exports exacerbated the effect of the global financial crisis, according to BNP Paribas SA data.

“Fear of another devaluation means nobody wants to buy rubles right now,” said Lars Rasmussen, an emerging markets analyst in Copenhagen at Danske Bank A/S, which rates itself among the five biggest traders of ruble in the world through Finnish subsidiary Sampo Bank Plc. “The ruble has begun to look more and more overvalued because of the fall in the oil price.”

Russia’s reserves, the world’s third-largest, have dropped by $171.6 billion to $426.5 billion since August, as policy makers sold currency.

The ruble weakened 1.4 percent to 37.8179 against the basket by 1:29 p.m. in Moscow, extending this year’s drop to 6.8 percent.

Lowered Forecast

Danske lowered its forecast for the ruble today, seeing a further 15 percent depreciation versus the basket to 44.45 in three months, down from a prediction of 38.6 in December.

The quickened pace of devaluations is encouraging investors to place so-called short positions on the ruble-basket rate, Rasmussen said. A short is a wager a security is going to decline.

Non-deliverable forwards predict an 11 percent decline in the ruble to 36.93 per dollar in the next three months. NDFs fix a currency at a particular level at a future date and are used by companies to protect against foreign-exchange fluctuations.

Bank Rossii, which manages the currency against a basket of about 55 percent dollars and the rest euros, widened its target range today, a bank official said. The currency has fallen 29 percent versus the basket since Aug. 1.

The ruble fell to 43.8880 per euro, the lowest since the common currency’s introduction in 1999, and is down 6.1 percent this year.

Crude Prices

Urals crude, Russia’s main export blend, has declined 69 percent to $44.43 a barrel from a record in July, below the $70 a barrel needed to balance the budget this year.

Russia’s MosPrime rate, the average interest rate banks charge to lend money to each other, rose to a two-month high of 12.5 percent today, according to the central bank.

To contact the reporter on this story: Emma O’Brien in Moscow at eobrien6@bloomberg.net

Last Updated: January 19, 2009 05:39 EST

-------------------------------

Buy Gold & Silver