Russians Buy Jewelry, Hoard Dollars as Ruble Plunges (Update1)

By Emma O’Brien and William Mauldin

Dec. 11 (Bloomberg) -- Moscow resident Tima Kulikov banked on the full faith and credit of the U.S. government, not the Kremlin, when he sold his biggest asset for cash.

The 31-year-old director of a social networking Web site initially agreed to sell his apartment for rubles, then cringed at the thought of the currency weakening as it sat in a lockbox pending settlement of the contract. It wasn’t until the buyer showed up with $250,000 stacked in old mobile-phone boxes and stuffed in his pockets that Kulikov closed the deal.

“The exchange rate we agreed on wasn’t great, but I did it because the money’s going to lie there for a month,” Kulikov said. “Put it this way, the ruble’s more likely to have problems than the dollar.”

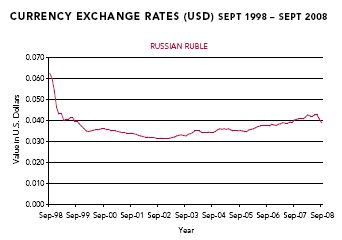

Russians are shifting their cash into foreign currencies and buying things they don’t need as the economy stalls and the central bank weakens its defense of the ruble, signaling a larger devaluation may be on the way. The currency has fallen 16 percent against the dollar since August, when Russia’s invasion of neighboring Georgia helped spur investors to pull almost $200 billion out of the country, according to BNP Paribas SA.

The central bank today expanded the ruble’s trading band against a basket of dollars and euros, allowing it to drop 0.8 percent, said a spokesman who declined to be identified on bank policy.

With the specter of the 1998 debt default and devaluation in mind, Russians withdrew 355 billion rubles ($13 billion), or 6 percent of all savings, from their accounts in October, the most since the central bank started posting the data two years ago. Foreign-currency deposits rose 11 percent.

Oligarchs Pinched

Those withdrawals are increasing pressure for the ruble’s devaluation, according to Basil Issa, an emerging- markets analyst at BNP Paribas in London.

Property is now a protective investment, not just a status symbol, said Sergei Polonsky, founder of real estate developer Mirax Group, which is building Moscow’s tallest skyscraper.

“Lately our clients are mostly those who buy real estate not to live in but to secure their investments,” Polonsky said. “No one wants to be left with pieces of paper.”

The 25 wealthiest Russians on Forbes magazine’s list of billionaires, including Oleg Deripaska and Roman Abramovich, lost a combined $230 billion from May to October as asset values plummeted, according to Bloomberg calculations.

‘Feel Happy’

For the burgeoning middle class, investments of choice range from electronics to gold jewelry. Evroset, Russia’s largest mobile-phone chain, is telling people to buy anything they can.

“It’s better to feel happy that you own something than to fear losing the money you have earned,” Chairman Yevgeny Chichvarkin says in a letter posted at 5,200 Evroset stores. “If you need a car, buy a car! If you need an apartment, buy an apartment! If you need a fur coat, buy a fur coat!”

Sales at Technosila, the third-biggest consumer electronics chain, have doubled since September as customers rush to swap rubles for flat-screen TVs and laptops, spokeswoman Nadezhda Senyuk said by phone from Moscow, where the company is based.

Jewelry sales are also accelerating, particularly items made of gold and diamonds, said Vladimir Stankevich, advertising director at Adamas, Russia’s third-largest jewelry retailer.

“More cash appeared on the market and there’s an opinion among shoppers that gold is a good investment in times of crisis,” Stankevich said.

Natalya Kulikova has a different approach. The 31-year-old sales manager said she’s opened accounts in rubles, euros and dollars at three different banks -- one foreign and two domestic -- to guard her savings.

“My main goal is to save money,” she said.

Putin Pledge

Those who don’t want to spend are keeping more money at home or in safe-deposit boxes because the government guarantee on bank accounts is limited to 700,000 rubles, said Yulia Tsepliaeva, chief economist in Moscow at Merrill Lynch & Co.

Alfa Bank, Russia’s biggest non-state lender, said demand for boxes has increased about 40 percent since October, and there are few available.

“The Russian experience with saving is not that good and people prefer to consume and enjoy rather than save in pre-crisis situations,” Tsepliaeva said. “Buy cash dollars and put them in mattresses or safe deposit boxes but not in accounts because most crises are accompanied by banking crises.”

A decade ago, many lost their life savings after the ruble plunged 71 percent against the dollar. Those fears prompted Prime Minister Vladimir Putin to pledge not to allow “sharp jumps” in the exchange rate, during a call-in television show Dec. 4.

‘Ideal Time’

Troika Dialog, Russia’s oldest investment bank, is betting the central bank will allow a one-time devaluation of the ruble of about 20 percent in January, following New Year’s and Orthodox Christmas celebrations.

“With the holidays at the beginning of January, companies won’t be fully working and people will be spending more money,” said Evgeny Gavrilenkov, Troika’s chief economist and a former acting head of the government’s Bureau of Economic Analysis. “That means demand for rubles will increase and that means it’s an ideal time to allow a devaluation.”

Russia has drained almost a quarter of its foreign-currency reserves, the world’s third-largest, since August as it tries to slow the ruble’s decline. The central bank has widened the trading band five times in the past month, effectively reducing its defense of the currency amid plunging oil prices.

Devaluation Skeptic

Urals crude, Russia’s main export earner, has slumped 72 percent since reaching a record $142.94 a barrel July 4. It fell below $40 for the first time in three years last week, compared with the $70 needed to balance the country’s budget.

The government will avoid a large, one-step devaluation because it wants to prevent a run on the banks and lure back foreign investors, said Chris Weafer, chief strategist in Moscow at UralSib Financial Corp.

“I’m skeptical a 10 to 15 percent devaluation will provide a significant boost for the economy because the sector that it will most benefit, manufacturing, is just too small,” he said.

The ruble will probably be allowed to drop in small steps to as low as 33 per dollar by the middle of 2009, from about 28 now, Weafer estimates. It will end next year at 26.8 because of a recovery in oil prices and a weaker U.S. currency, he said.

Svetlana Guseva isn’t taking any chances.

The 32-year-old mother of two from the southern city of Sochi plans to take her 8-year-old daughter, Dasha, to Moscow for the New Year’s holiday, a trip that will cost twice her family’s monthly income of about 30,000 rubles.

“This way at least we’ll have some memories,” she said.

To contact the reporters on this story: Emma O’Brien in Moscow at eobrien6@bloomberg.net; William Mauldin in Moscow at wmauldin1@bloomberg.net.

Last Updated: December 11, 2008 03:51 EST

-----------------------------

Buy Gold & Silver